3 Ways to Kick-start Financial Success for Your Children

1. Financial Education

Growing up, my friends and I often discussed how we would contribute to breaking the cycle of poverty in our families and communities. We would reflect on how our circumstances influenced the decisions we made as well as how those decisions shaped who we are today.

The First Step to Accumulating Wealth & Taking Control of your Finances

And just like that it’s 2018. The beginning of the year is when most take the time to reflect on what went well in the previous year as well as identifying areas of growth in the New Year. The past couple years I’ve seen a common theme of individuals choosing to take control of their financial destiny as one of their New Year Resolutions,

Nobody’s Perfect: How I Changed My Financial Trajectory

Dollar and a Dream: Bag Secured, but would it be fumbled?

In September of 2017, I started my career in public accounting as an auditor and was more than ready to start reaping the benefits of the bag I secured. Coming from a low income background, my financial priorities were in disarray as I only valued material items such as clothes, shoes, and other

7 Things You Need to Sacrifice to Stop Overspending & Reach Your Financial Goals

Let’s face it. We all buy things we do not need with money we often do not have. Welcome to the day that you decide to no longer trade your hard-earned income for items that will not add any value to your life.

The Simple Budget Hack That Will Save You Hundreds!

When I first began budgeting almost a year ago, I was super unorganized and used one account to pay bills, buy groceries & gas, pay down debt, invest, and for other miscellaneous spending. This made it tougher to stay on budget & keep track of where my money went every month, so I switched to having multiple accounts!

How Your Childhood Affects Your Current Money Mindset

Have you ever stopped to reflect on how your upbringing has positively or negatively influenced your current money mindset?

Maybe you grew up in a low income household being denied things you wanted, so now you tend to overspend and call it “treating yourself”, or

What Every Professional Should Know Before Investing in a 401(k)

Nowadays, 401(k) retirement accounts are offered by most employers as they appear to be an attractive option, as employees can contribute on a pre-tax basis, thus reducing their taxable income, its earnings grow tax-deferred, and employers typically offer to match your contributions. Sounds great right? Let’s discuss further.

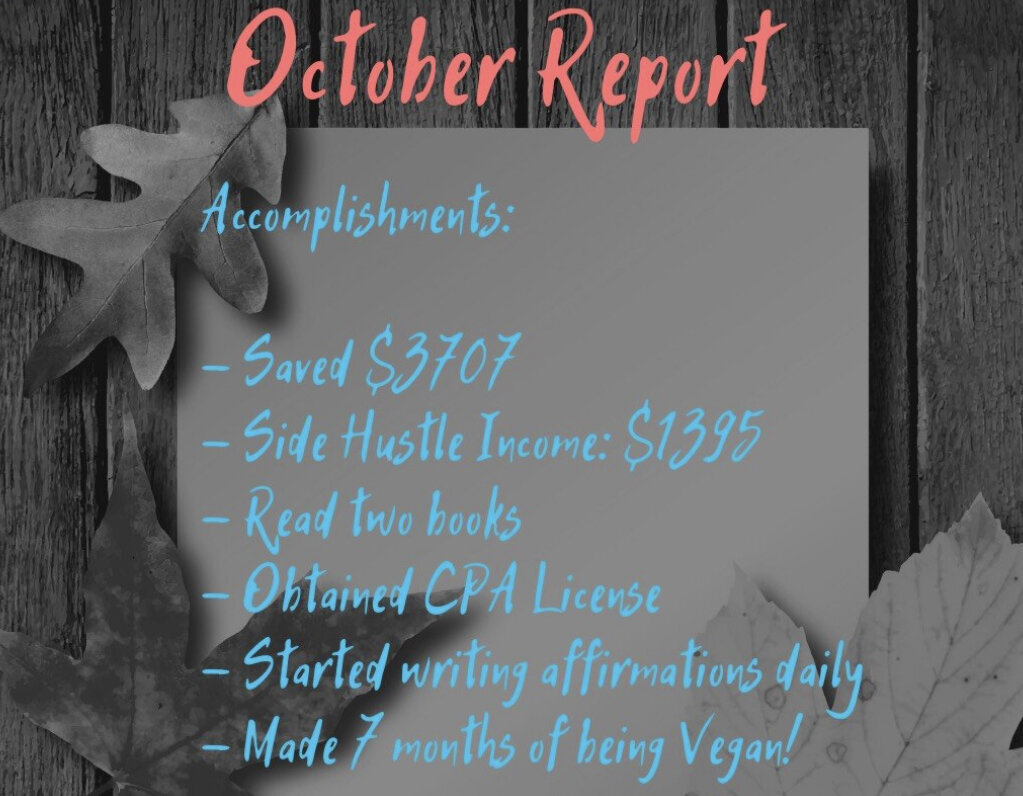

Reflection Time: October Report

“Time spent in self-reflection is never wasted – it is an intimate date with yourself.” -Dr Paul TP Wong

It’s always great to reflect at the end of each month on your financial, physical, mental, emotional, and spiritual well-being, so you can start each month fresh, capitalize on your successes from the prior month, and identify areas you can improve.

School is in session! Financial Mistakes Every College Student Should Avoid (Part 1)

This blog is brought to you by reflection. Reflection is so powerful, but often we find ourselves immersed in technology and other distractions that obstruct our willingness to take a step back and reflect.

School is in session! Financial Mistakes Every College Student Should Avoid (Part 2)

Whew! January seemed like it would never end, but finally we are headed into February. Hopefully, you’ve moved the needle on any goals/resolutions you set before the end of the year. If not, get to it!

February is a month we look forward to for several reasons,

The R A I N Y Days Will Come!

This is why it is imperative that you are prepared for any and everything that life throws your way!

They say that

– “If you stay ready you’ll never have to get ready”

They also say that

– “By failing to prepare, you’ll preparing to fail”

7 Tips to Improve Your Finances Today

2020 is in 4 months..don’t wait till its time to create a new year resolution to get your finances in order.

Start now with these 7 tips

1. Analyze your money mindset: who influenced your money habits & mindset

5 Ways Individuals with Disabilities Can Protect Their Family’s Fiscal Future

Managing our finances is tricky enough — and if you or a loved one has a disability, there’s an added layer of complication. Fortunately, there are plenty of ways for individuals and families with disabilities to prepare for a secure and stable financial future.

8 Things You Should Do..Before Paying Off Debt

1. Analyze how much debt you have, what the interest rates are, and what the minimum payment is for each debt. So you understand the full magnitude of your situation.

2. Understand what habits & decisions

Why Owning A Business is the GOAT of Tax Loopholes

Companies such as Amazon, GM, Delta Airlines, Netflix, pay little to no tax every year because... Businesses 1. Earn income 2. Pays business expenses 3. Then pays tax on what is left This allows businesses to substantially reduce their taxable income, as the business expenses reduce it dramatically.

How the Rich Get Richer and Why You Should Too (A Short Story)

Although there are plenty of reasons that contribute to and help explain the huge wealth gap, one nuance that isn't discussed often by the masses is the following...

Why you should always monitor your Debt to Income Ratio (DTI)

Someone sent me a DM saying, how come no one talks about the income needed to get approved for an FHA loan? They only really talk about the credit scores needed and the 3.5% down payment?

The Most Underutilized Weapons: Your Mind and Your Attention

Many people extremely underestimate how huge of an asset your mind and attention are. I mean think about it, companies spend billions in advertising each year to capture your attention...